tax on unrealized gains uk

You buy 1 ETH for 4000. Under the Internal Revenue Code of 1986 is predicated upon gross incomewhich the US.

Frequently Asked Questions Blackrock

The price of BTC has increased by 3000 but you havent sold your asset.

. Answer 1 of 7. Supreme Court has taken to mean an accession to wealth that is clearly realized. Households worth more than 100 million as.

Taxable income in the US. The proposal would allow billionaires to pay this initial tax. The new proposal would tax unrealized capital gains meaning that the wealthy would no longer be able to defer tax payments on gains made each year.

Talk of a tax on unrealized capital gains has surfaced again as politicians seek ways to squeeze as much out of the American people as they can to fund Joe Bidens tenure-defining 6 trillion spending plans. Unless there is a piece of legislation somewhere which deems the revaluation to be a. You have an unrealized gain of 3000.

The value of these stocks has increased to 25000. A new tax could require the wealthy to pay least 20 even on unrealized appreciation. You buy 05 Bitcoin for 30000.

Biden also called for the top capital gains tax rate to be the same as his top proposed rate on other income at 396. Actually this happens to self-employed people in the UK already but. The basic tax rule in the UK is that foreign exchange movements on loans and derivatives are taxabletax deductible as they accrue.

The proposed 20 tax on unrealized gains was put forward by the US Department of Treasurys 2023 Income Proposition. Households worth 100 million or more is drawing skepticism from tax experts. According to the official justification to the Project the purpose of the regulation is to adjust the Polish tax provisions to the EU law.

John Gimigliano the head of. All references are to Corporation Tax Act 2009 CTA 2009 unless otherwise stated. It can potentially become a penalty for being successful according to Shehan Chandrasekera Head of Tax obligation.

President Joe Biden will propose a minimum 20 tax rate that would hit both the income and unrealized capital gains of US. Macomber and Glenshaw Glass Co. This creates an increased risk of unexpected taxable gains for companies.

As a general rule no. The ATAD Directive which regulates the unrealized capital gains taxation in the case of. A year ahead of time based on what your contracted salary was.

Again under Bidens plan they would be required to pay a minimum 20 income tax on this appreciation. This reflects the 10k investment and the 5k unrealised gain. I understand there has to be a fair value adjustment in the PL to refelct the increased value of the investment to 15k.

In total 215 billion could be collected over nine years with Musk paying the most at 50 billion. Are the leading cases. The Company could record 15000 as Unrealized gain on these positions without actually selling the securities.

In this article we go back to basics on the taxation of foreign exchange from a UK corporation tax perspective and also consider some of the options available to businesses to enable certain foreign exchange volatility to be managed from a tax perspective. Below are one economists estimates of what the top 10 wealthiest Americans would owe on their unrealized capital gains alone. Although the aim of the FA 1993 legislation was to bring the taxation of exchange gains and losses.

Approach at crypto tax software application specialist CoinTracker. This means that tax liabilities can arise from exchange gains which are unrealised and so are unfunded. In simple terms a foreign exchange gain or loss is realised when a transaction is finalised and unrealised whilst it is still in progress.

Senate Finance Committee Chairman Ron Wyden D-Ore talks to reporters in. Under the proposed Billionaire Minimum Income Tax households with a cumulative annual income over 100 million could face a sizable 20 tax bill that includes the sum total of their unrealized gains. As a result of section 2 1 and 2 of CTA 2009 corporation tax is charged on chargeable gains accruing to a company on the disposal of assets You dont have a disposal of assets so it does not fall within TCGA 1992.

But one aspect of his proposal a minimum 20 tax on the unrealized gains of US. Why you ask let me give you an example You purchased stock in Alibaba Inc. Since then many wealth managers from Howard Marks to Peter Mallouk as well as many others have argued that this.

Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. However it was my understanding that unrealised gains of this nature should be stripped out of the calculation for Corporation Tax. If you buy crypto and it goes stratospheric there could be a new 20 tax rate if you are worth more than 100.

Yellen had first proposed the tax on unrealised capital gains in February 2021. See the Business Income Manual BIM39500 for the rules relating to unincorporated businesses. A further complexity arises in the.

For 30 a share in 2018 and it went up to 300 as of 31 December 2018 and you own. For these 13 billionaires total unrealized gains add up to more than 1 trillion. Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022.

Its the gain you make thats taxed not the. Lets look at an example and for ease lets say that GBP 1 is worth US 2. It will only be paper profit and the Company will not be liable to pay any taxes for such recorded Unrealized gains.

The proposed amendments are intended to correspond with Article 5 of the EU Council Directive 20161164 dated 12 July 2016 hereinafter. You buy 200 worth of goods from the USA on 30 days credit so you have an expense in your accounts of 100 because at the. No because TCGA 1992 s2 1 states.

Again under Bidens plan they would be required to pay a minimum 20 income tax on this appreciation. You buy 1 ETH for 4000. You later sell your ETH for 3500.

You have a realized loss of 500. If the proposal were to pass billionaires. March 26 2022 229 PM PDT.

It would screw the person paying the tax that is how it would work. Below are one economists estimates of what the top 10 wealthiest Americans would.

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

Crypto Tax Unrealized Gains Explained Koinly

Crypto Tax Unrealized Gains Explained Koinly

12 Ways To Beat Capital Gains Tax In The Age Of Trump

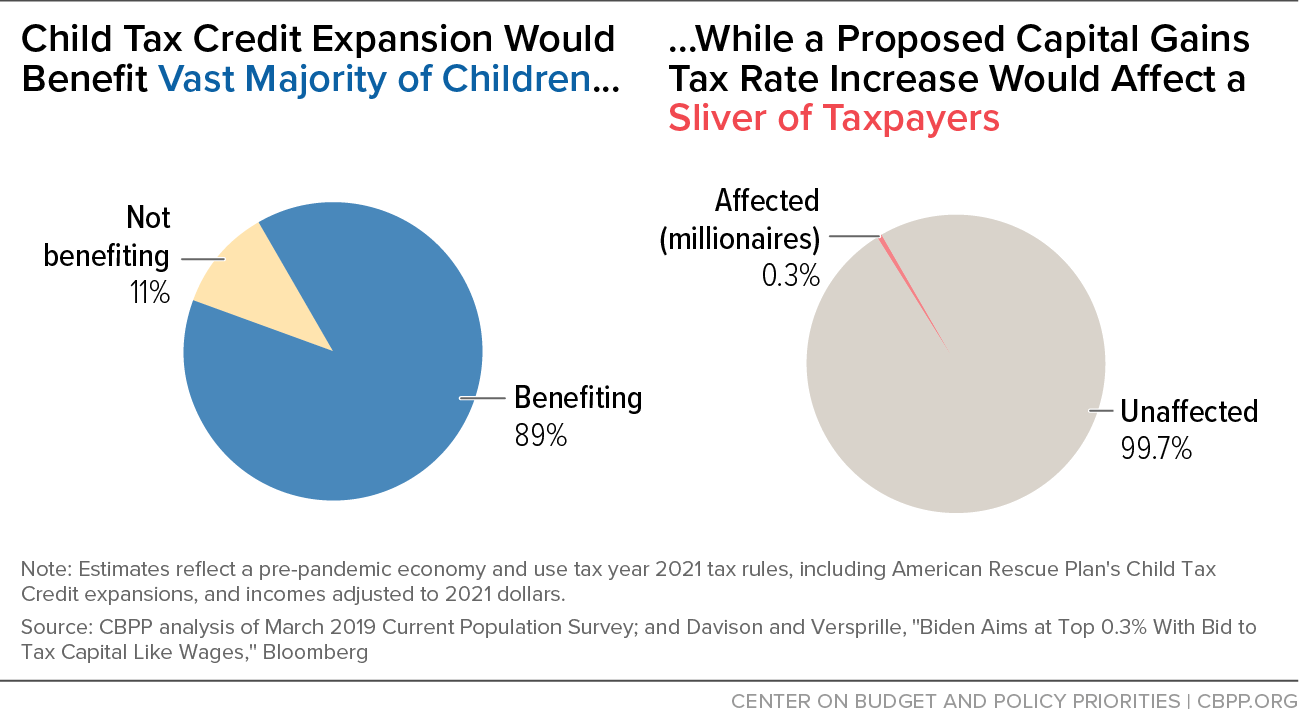

On Tax Day 9 Charts On The System S Inequities And Plans To Address Them Center On Budget And Policy Priorities

Unintended Consequences Of Taxing Unrealized Capital Gains Investing Com

Other Comprehensive Income Overview Examples How It Works

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

Capital Gains Yield Cgy Formula Calculation Example And Guide

Crypto Tax Unrealized Gains Explained Koinly

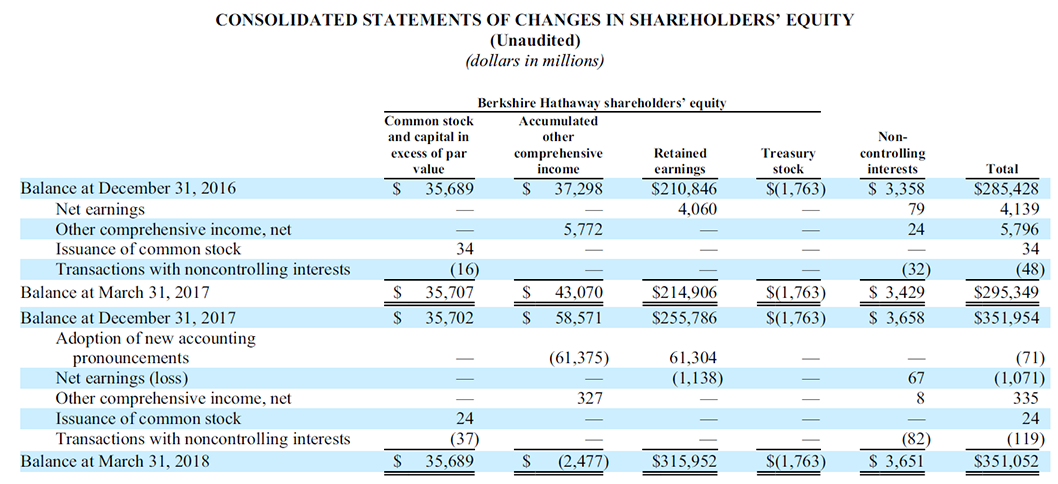

Berkshire S Bottom Line More Relevant Than Ever Before Cfa Institute Market Integrity Insights

How To Tax Capital Without Hurting Investment The Economist

Crypto Tax Unrealized Gains Explained Koinly

On Tax Day 9 Charts On The System S Inequities And Plans To Address Them Center On Budget And Policy Priorities

Winter Is Coming Plan Ahead For Potential Tax Changes Context Ab

Pass Through Entity Owners Bear The Hit With Proposed Federal Tax Law Changes

Hill Democrats Shift From Raising To Cutting Taxes On The Merely Rich

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)